What Makes Us

Our goal is to bridge the gap between technical and fundamental market analysis using natural language processing and targeted text-mining research. Our data aides financial analysis and risk management decisions on increasing returns and avoidance of severe losses.

Figure 1: Machine learning topic classification.

Qualitative Data

Quantitative Results

Financial statements, reports, news and social media, all of these contain a wealth of information acted on by institutional and retail investors alike. Eribol has collated a growing database of 180,000+ unique text-based records dating back to 1986.

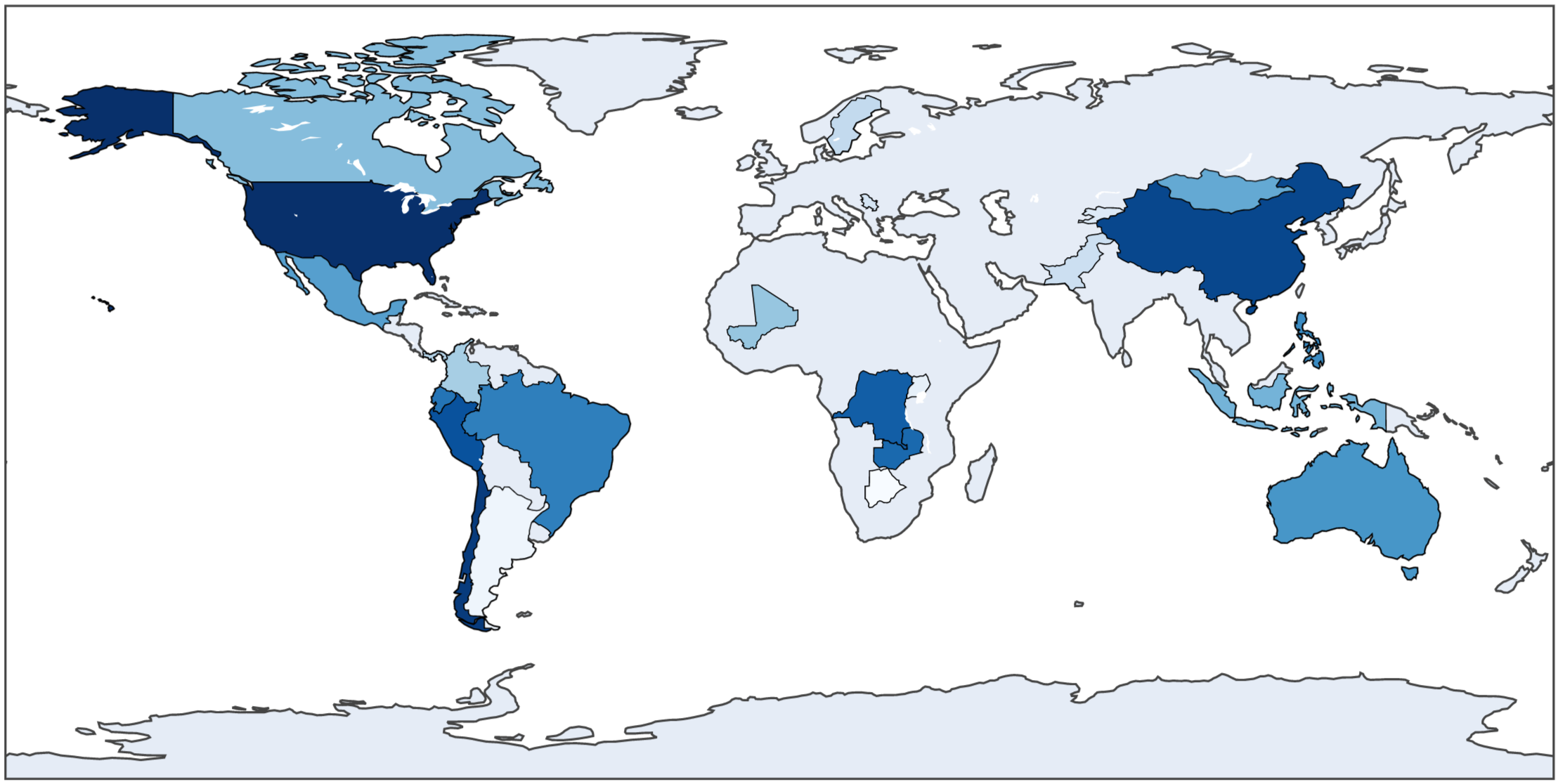

Figure 2: Copper media coverage ranked by country (2019).

Our Toolbox

Our Insight

We have developed a custom Natural Language Processing pipeline. By training Machine Learning algorithms on information within the mining and metals sector, we identify, tag and measure trends and events encompassing topics such as commodities, companies and countries that influence market behaviour.

Figure 3: Base metal Impact Index comparison.

Correlation

Causation

Eribol applies an effective interdisciplinary approach of data science, linguistics and behavioural economics in forecasting commodity and equity technical indicators. Unlock the insight advantage from natural language data to manage risk and spot opportunities within the mining and metals sector.

Figure 4:Sentiment Index comparison between a commodity and company.

Gold Forecast.

Whether you're a trader, analyst or risk manager, get access to our monthly gold price forecasting. Our reports equip you with unique insights from natural language processing.

Figure 5: Gold price forecasting using natural language processing.